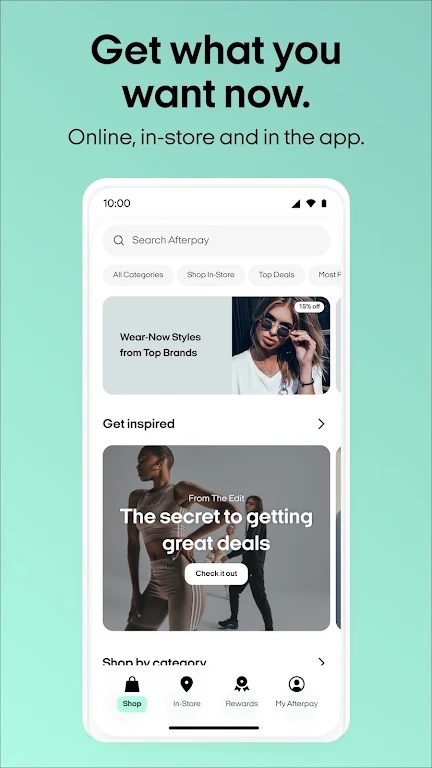

Afterpay - Buy Now, Pay Later is a modern financial technology app designed to offer users a smarter way to shop. By allowing purchases to be paid in installments, Afterpay provides a flexible and interest-free payment solution for both online and in-store transactions. With partnerships across a wide range of retailers, users gain access to countless products and services—all while enjoying a seamless and intuitive shopping experience. The app’s user-friendly interface and streamlined checkout process make it easy to buy now and pay later without the burden of interest or hidden fees.

Key Features of Afterpay - Buy Now, Pay Later:

App-exclusive shopping perks: Enjoy special deals and discounts available only through the Afterpay app, with access to a diverse selection of top brands.

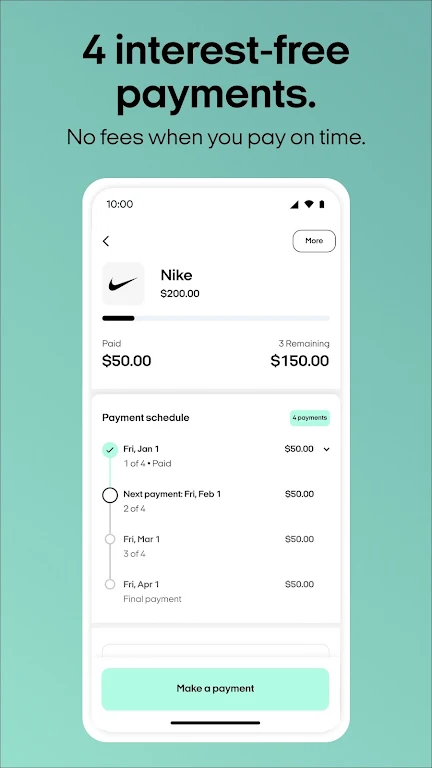

Split payments into 4 interest-free installments: Break your purchase total into four manageable payments, simplifying budget control.

Extended payment terms (6 or 12 months): For larger purchases, choose to pay over 6 or 12 months at select retailers—offering greater flexibility.

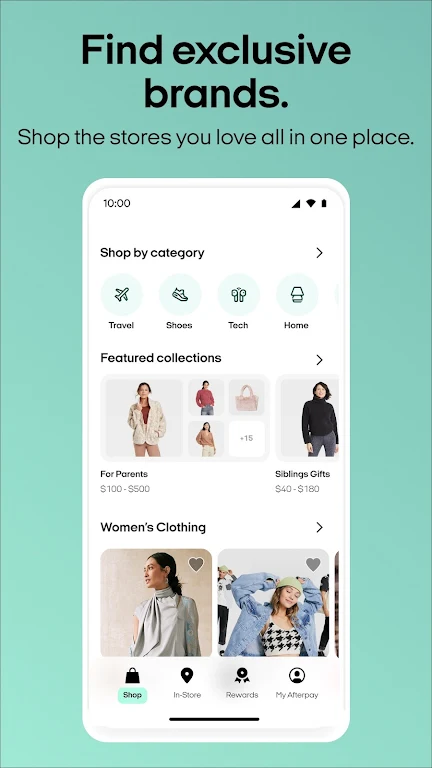

Exclusive app-only brands: Discover unique stores and products that are only accessible via the Afterpay platform.

Frequently Asked Questions:

Can I use Afterpay at physical stores?

Yes, Afterpay is accepted at numerous retail locations, making it ideal for all types of shopping experiences.

How can I manage my payment schedule?

You can easily adjust your payment dates, pause payments during returns, and track your order history directly within the app.

How do I get notified about sales and price drops?

Enable push notifications to stay informed on product discounts and sale events for your favorite items.

App-Only Shopping Benefits

Afterpay enhances your shopping journey by offering exclusive benefits through its mobile app. Browse and purchase from a broad network of brands, all while splitting your payments into four interest-free installments. The app allows you to explore stores, products, discounts, and gift cards across multiple categories including fashion, beauty, home goods, toys, electronics, and more—whether shopping online or in person.

Flexible Payment Solutions

Afterpay continues to evolve by introducing extended payment plans. At participating retailers, users can opt to pay over 6 or 12 months, giving them the freedom to invest in high-value items without overwhelming their monthly budget.

Exclusive Brands and Categories

The Afterpay app features curated collections and brands that are only available through the platform. From fashion to tech, uncover unique items not found elsewhere. Plus, benefit from daily shopping guides and trend-focused content to keep you informed on what's new and what’s trending.

Effortless Order Management

Stay on top of your spending with Afterpay’s built-in tools. View current and past orders, modify payment schedules, or pause payments when returning an item. For added convenience, integrate Afterpay with your Cash App account to manage everything from one place.

Real-Time Sale and Price Drop Alerts

Ensure you never miss out on a deal with instant push notifications for sales and price reductions. Save items within the app and receive alerts when prices drop—so you always get the most value from your shopping.

In-Store Shopping Made Simple

Afterpay isn’t just for online shopping. Add your Afterpay card to your digital wallet and enjoy the same flexibility in physical stores. The app clearly displays your pre-approved spending limit, helping you shop responsibly and stay within budget.

Boost Your Spending Limit

Increase your purchasing power by consistently making timely payments through the Afterpay app. Afterpay encourages responsible spending habits and rewards positive financial behavior with potential spending limit increases.

Around-the-Clock Customer Support

Need help? Afterpay offers dedicated customer support through the app, available 24/7. Access FAQs, chat with support agents, and resolve issues quickly and efficiently.

Terms and Conditions

To use the Afterpay app, users must accept the applicable [Terms of Use] and [Privacy Policy]. Eligibility requirements include being at least 18 years old, a U.S. resident, and meeting additional criteria. Some in-store purchases may require further verification. Late fees may apply—please review your installment agreement for full details. Loans provided to California residents are made or arranged pursuant to a California Finance Lenders Law license.

The Pay Monthly program is offered through loans issued by First Electronic Bank, a Member of the FDIC. A down payment may be required, and APRs range between 6.99% and 35.99%, based on eligibility and merchant. These loans involve a credit check and are not available in every state. Applicants must have a valid debit card, accessible credit report, and agree to final terms. Please note that estimated payments shown exclude taxes and shipping fees, which are applied at checkout. Full program terms are available on the Afterpay website.